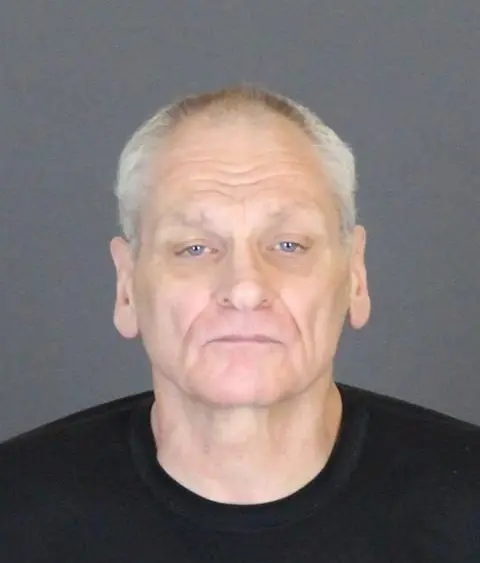

State Rep. Greg Alexander Wednesday voted for plans that would fix local roads without raising taxes or taking on additional debt.

The legislation – House Bills 4180-87 and 4230 – would annually put over $3 billion toward roads, including $2.5 billion to local roads. Alexander said the added resources will be critical for locals who have delayed projects or been forced to shift money away from other critical services to fund repairs.

The roads plan would annually rededicate $2.2 billion from the Corporate Income Tax (CIT) to roads, shifting $220 million to the Michigan Department of Transportation (MDOT), $1.1 billion to counties, and $880 million to cities and villages. The plan would also reallocate hundreds of millions of dollars from expiring or inefficient spending programs.

The bills remove the sales tax on fuel and replace it with a fair, fixed motor fuel tax, securing nearly another $1 billion for roads without raising taxes. The legislation will hold school funding harmless by dedicating $755 million in sales tax revenue to account for the decrease in what is normally allocated through gasoline sales tax.

Alexander specifically noted a bill within the legislative package that creates the Neighborhood Roads Fund, which would distribute money to local municipalities based on their number of various road miles, not on the ability to generate matching funds.